SMM January 17 News:

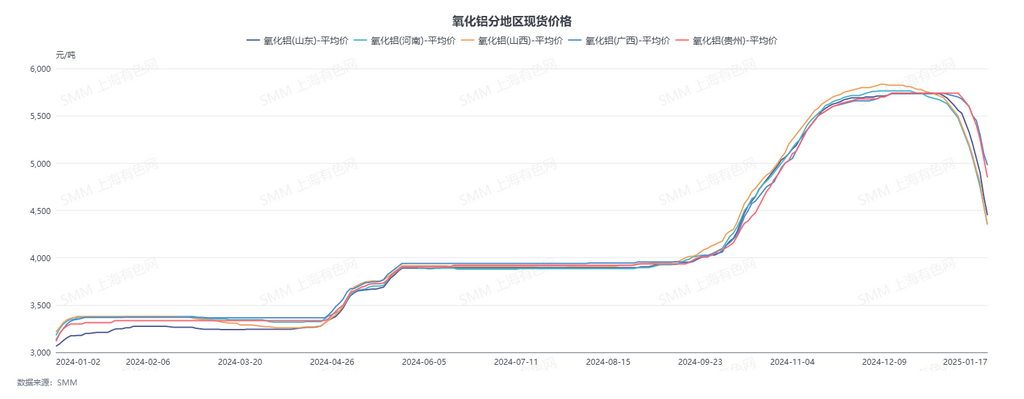

In 2024, the domestic alumina market experienced frequent disruptions. The supply gap of bauxite limited the increase in domestic alumina capacity, overseas alumina production cuts occurred, and the resumption of aluminum production in Yunnan was earlier than expected. During the dry season, no power rationing or production cuts were observed. Under the resonance of multiple bullish factors, the SMM alumina index price surged from 3,154 yuan/mt at the beginning of the year to 5,698 yuan/mt at year-end, marking a significant increase of 80.66%.

Q1: Domestic Ore Supply Reduction, Tight Alumina Supply Drives Price Increase

At the end of 2023, large-scale production cuts and suspensions occurred in bauxite mines in Shanxi. In Q1 2024, domestic ore production in Shanxi and Henan did not resume, and some alumina refineries in south-west China also faced insufficient bauxite supply. The tightness in bauxite supply intensified, and temporary procurement of imported ore faced significant challenges. Coupled with the impact of winter environmental protection policies in northern China, alumina producers were forced to cut production, resulting in an overall tight supply of alumina. Spot prices rose significantly compared to Q4 2023. The average SMM alumina index price in Q1 2024 was 3,328 yuan/mt, up 326 yuan/mt from 3,002 yuan/mt in Q4 2023, expanding alumina profit margins.

From late February to March, driven by the expanded profit margins, some alumina refineries supplemented raw materials by procuring imported bauxite, leading to an increase in operating rates. Spot prices in northern China saw a slight correction, while in southern China, due to the resumption of aluminum capacity, increased demand provided stronger support for spot prices, which remained stable overall.

Q2: Domestic Bauxite Mine Resumption Expectations Unmet, Overseas Supply Reduction

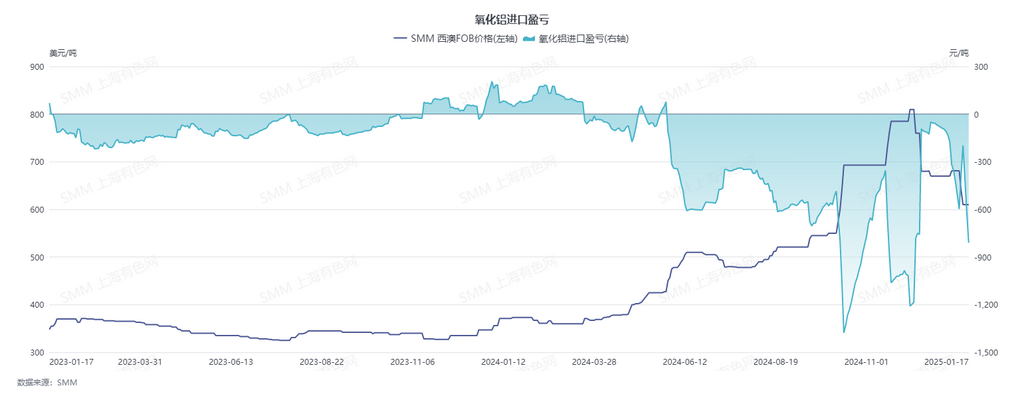

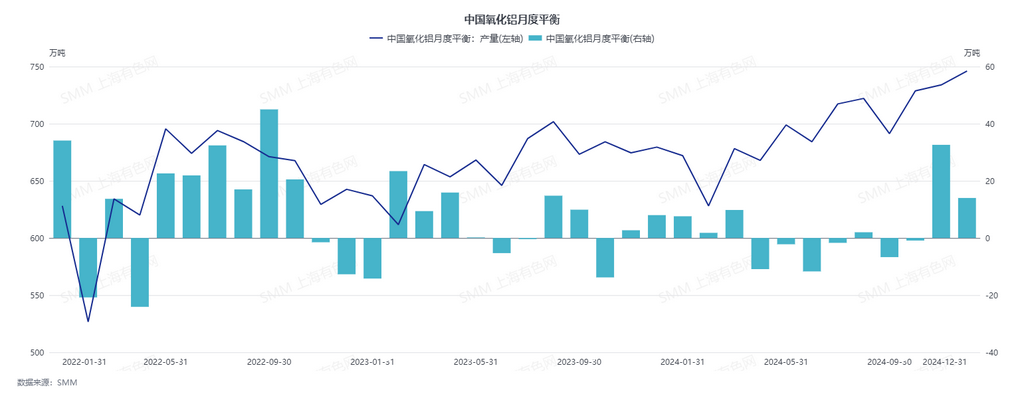

The large-scale resumption of bauxite mines in Shanxi and Henan once again failed to materialize. Alumina refineries generally opted to supplement with imported bauxite, but temporary procurement of imported ore remained challenging, and supply stability was insufficient. Alumina refineries simultaneously increased and reduced production, with raw material constraints limiting the increase in domestic alumina production. Overseas, Australian alumina supply decreased, with FOB prices in Western Australia rising from $369/mt to $505/mt. Alumina import profitability turned to losses, and China shifted from being a net importer to a net exporter of alumina. Domestic alumina supply increases faced constraints, and combined with significant reductions in overseas alumina supply, the domestic alumina market shifted from a slight surplus to a deficit. As a result, spot alumina prices surged again.

The average SMM alumina index price in Q2 2024 was 3,655 yuan/mt, up 327 yuan/mt QoQ. By the end of June, the SMM alumina index was reported at 3,903 yuan/mt, up 18.24% from 3,301 yuan/mt in early April.

Q3: Spot Alumina Prices Stabilized at High Levels, Signs of a New Price Surge Emerged

In the first half of Q3 2024, no new imbalances emerged in the alumina market, but existing imbalances showed no significant easing. Amid back-and-forth negotiations between upstream and downstream, the market was dominated by long-term contract execution, with sluggish spot transactions. The SMM alumina index price remained stable around 3,900 yuan/mt. In the latter half of Q3, the market anticipated that alumina supply-demand imbalances would intensify in winter, with the supply side potentially affected by environmental protection policies. As arbitrage opportunities between futures and spot markets opened, demand for delivery brands increased, coupled with rising winter stocking demand from aluminum smelters. Signs of a new round of significant price increases began to emerge.

The average SMM alumina index price in Q3 2024 was 3,929 yuan/mt, up 274 yuan/mt QoQ. By the end of September, the SMM alumina index was reported at 4,092 yuan/mt, up 4.84% from 3,903 yuan/mt in early July.

Q4: Alumina Supply-Demand Imbalances Intensified, Spot Prices Surged Beyond Expectations

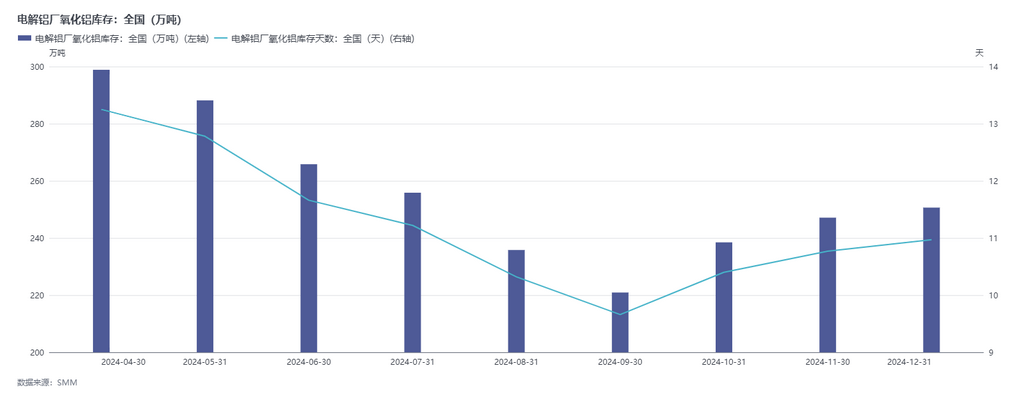

Demand side: On one hand, alumina supply remained tight, with deficits observed in Q2 and Q3. High prices affected downstream stocking enthusiasm, and aluminum smelters' alumina inventories were lower than the same period last year, leading to strong proactive stocking expectations downstream. On the other hand, no power rationing issues occurred in Yunnan, and aluminum production demand for alumina remained robust. Supply side: The rainy season in Guinea lasted longer and had a greater impact than expected. From September to November, Guinea's bauxite imports remained at low levels, and the supply gap persisted, limiting alumina capacity increases to some extent. Additionally, during the heating season, environmental protection policies occasionally impacted alumina supply increases. Supply-demand imbalances intensified, and by the end of December, the SMM alumina index price was reported at 5,698 yuan/mt, up 38.70% from 4,108 yuan/mt in early October.

However, with expanded alumina profit margins, alumina refineries were highly motivated to increase production, and operating capacity rose steadily. Starting in November, the alumina market shifted from a deficit to a surplus. Despite this, due to proactive stocking demand from aluminum smelters, the spot market did not show a significant surplus. By mid-December, prices still fluctuated upward. However, as downstream alumina raw material inventories increased and spot prices continued to rise, downstream stocking sentiment weakened. With operating rates remaining high, the spot market gradually shifted to a surplus, and spot alumina prices began to pull back slightly. By the end of December, the SMM alumina index price was reported at 5,698 yuan/mt, down 71 yuan/mt from the mid-December peak of 5,769 yuan/mt.

2025 Outlook: Rising Ore Prices Push Cost Support Higher, Large-Scale New Capacity Expected to Increase Production

In 2025, bauxite supply is expected to increase, alumina operating capacity is likely to remain high, and aluminum capacity may see minor technological transformations and production cuts. Combined with the absence of proactive stocking demand, the overall alumina market is expected to show a surplus. With increased availability of spot cargoes in the market and expectations of price declines, some suppliers are likely to actively sell, leading to frequent low-price transactions and accelerated declines in spot alumina prices.

For the full year, as bauxite is not expected to experience significant surpluses in 2025, the average bauxite price is anticipated to rise compared to 2024, pushing alumina cost support higher than in 2024. However, with over 10 million mt of new alumina capacity expected to come online in 2025, alumina production is projected to increase further. The alumina market is expected to show a slight surplus. Without other disruptive factors, the alumina industry is unlikely to replicate the significant profitability seen in 2024, and spot prices are expected to decline significantly from the beginning of the year.

(The above information is based on market data collection and comprehensive evaluation by the SMM research team. The information provided is for reference only and does not constitute direct investment research advice. Clients should make cautious decisions and not substitute this for independent judgment. Any decisions made by clients are unrelated to SMM.)

Data Source: SMM Click on the SMM Industry Database for more information

(Mingxin Guo 021-51595800)